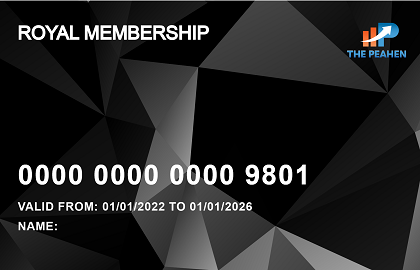

Royal Membership Card

Royal Membership Card - Unlocking The Best Personal Loans

Go Ahead For Your Convenient Personal Loan With Royal Membership Card

You may just grow yourself out of financial difficulties by using Peahen. For immediate access to our specialists, apply for a membership card. Additionally, you can access our services from anywhere and at any convenient moment. Our well-qualified are always on-board on for you.

Rs. 1000.00 499.00 only

Buy Now

Royal Membership Card's Awesome Aspects

Personal Loan Offers From Multiple Banks

Once we gather your loan-related documents, we will quickly file your loan application in our partnered banks and financial institutions. Then, the NBFC banks will check your profile and match it to their respective loan eligibility criteria. After this, we will give you the loan offers from the banks in which your profile is matched.

Get Free Loan Expert Consultancy for 1 months

We believe in helping you with all our efforts! Serving the same purpose, purchasing a membership card enables you to get free expert consultancy through which you will be guided towards fetching suitable personal loan offers.

Get 40% Referral Payout as Reward

Besides getting personal loan offers from our partnered banks, you can make a good income through easy refer and sharing, and you can earn up to 40% referral commission from us.

Quick Loan Approval

You can get a personal loan of up to Rs. 15 lakhs in just 30 minutes! Our quick services will aid you in getting your personal loan with the quick loan approval. Still, the final timeframe and loan details depend upon the concerned banks' criteria and the customer profile.

Excellent On-Call Support

In order to clear your doubts and entertain your queries, we are more than happy to connect with you via our on-call support. Through this, you will be able to get appropriate answers to all your questions.

No Effect On CIBIL Score

One of the best features of buying a Royal Membership Card is that even after multiple bank verification, there will be no impact on the loan applicant's CIBIL score.

Most Optimized Way Towards Personal Loan - How it works?

1. Registration

2. Check Eligibility

3. Buy Membership Card

4. Submit Documents

5. Bank Verification

6. Bank Sanction

You can check all the company Terms & Conditions here: https://thepeahen.in/terms-conditions